Table Of Content

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. Not every lender uses the same standards for mortgage qualification, whether you’re buying a $70,000 home, a $700,000 home or a $7 million home. No matter where you are, though, housing affordability likely nags you. Real estate platform Zillow reported in February 2024 that the average U.S. household needed to earn roughly $106,000 to “comfortably” afford a typical home. That amount is $25,000 above the typical U.S. household income cited by Zillow—about $81,000. In the Searles Valley, the median household income was $54,000 in 2022, well below the statewide average of $92,000, according to census data.

How we make money

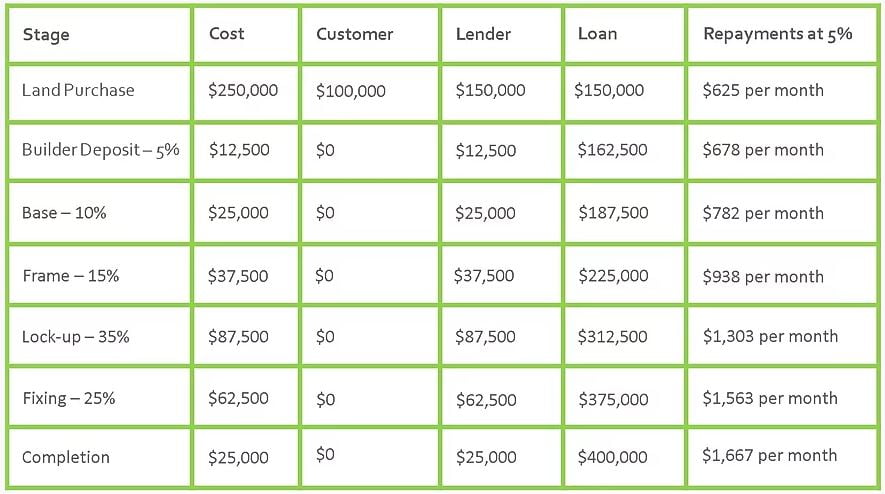

You’ll generally need a 20 percent down payment and a credit score of 680 for this sort of financing, though the terms can vary by lender. A draw schedule is the plan that details how you will send funds to the builder. When building a home, you don’t send the entire loan disbursement to the builder before the project even starts. Rather, your lender will release funds slowly as each project milestone is completed. In this way, you minimize losses in the case of a dishonest builder, or one that simply goes out of business during your project.In this way, a construction loan resembles a line of credit.

Banking and Investing

In other words, the interest rate will change at regular intervals, unlike fixed-rate mortgages. These types of loans are best for people who expect to refinance or sell before the first or second adjustment. Rates could be substantially higher when the loan first adjusts, and thereafter.

Fixed-Rate & Adjustable-Rate Loans

For personal advice regarding your financial situation, please consult with a financial advisor. Building a house or buying a house that's under construction — rather than purchasing an existing home — provides an opportunity for some personalization. You'll need to think about financing the building phase as well as the completed home. In addition to strategizing how to get the lowest interest rate, consider which loan will save you the most. For example, since a construction-to-permanent loan only requires one closing, you can potentially save on closing costs.

DAILY COVER STORY

Fortunately, you can visit the US Department of Housing and Urban Development’s (HUD) website to search for FHA lenders, although not all FHA lenders offer FHA construction loans. Lastly, you close on the loan and begin the process of building your dream home,” he says. The FHA 203(k) loan is tailored for the rehabilitation and renovation of existing homes. This loan type is especially beneficial for purchasing fixer-uppers or upgrading your current home.

A closer look at the numbers

While we’ll go over several types of financing for building your home, we offer end loans, which are the permanent financing after the home is built. However, there are several other loans available when it comes to home building, from ground-up building to a complete remodel of the entire house. There’s likely a loan out there that’s right for you, whether you’re starting from scratch with a land loan or completely renovating a home. Once approved, you’ll be able to start accessing the funds in conjunction with each phase of construction. An appraiser or inspector will check in on the build throughout the construction process so that the borrower can continue to have access to funds. All in all, a construction-to-permanent loan is the more streamlined option, but not all lenders will offer this to all borrowers.

financing a homeA homeowner’s guide to home equity loans

USDA Construction Loan: Rates and Requirements for 2024 - The Mortgage Reports

USDA Construction Loan: Rates and Requirements for 2024.

Posted: Fri, 16 Feb 2024 08:00:00 GMT [source]

These loans allow borrowers to lock in their interest rates at the start of construction and not have to worry about rate fluctuations while the project progresses. There’s only one closing, so you’ll just have to pay closing costs once. On average, you can expect interest rates for construction loans to be about 1 percentage point higher than those of traditional mortgage rates. Like interest rates for other types of loans, rates on construction loans generally vary based on the borrower’s creditworthiness, the size of the loan and the loan term. What’s more, interest rates for construction loans typically are variable, meaning they adjust over the course of the loan based on an index, like the prime rate. Like with any home loans, you’ll need to meet a certain set of requirements in order to apply for a construction loan in California.

What Is An FHA Construction Loan? - Bankrate.com

What Is An FHA Construction Loan?.

Posted: Mon, 01 Apr 2024 07:00:00 GMT [source]

How To Choose a Construction Loan

To qualify for a home construction loan, you will likely need to have good credit, stable income, and a down payment. Specific requirements will vary between lenders, so be sure to research and compare different lending institutions before making a decision. Lenders will also likely require an appraisal, detailed plans and specifications, and proof that you own the land on which you plan to build. Additionally, lenders may want to see a budget for the projects, which could include the cost of the land, building materials, labor costs, and other expenses. The borrower will need to look for a homeowners insurance policy that includes builder’s risk coverage.

Building a new home from the ground up can be an exciting and rewarding experience. There can be many advantages to owning a brand-new house, such as higher energy efficiency, lower repair costs, and the opportunity to customize many features. Unless you can cover the sale price in cash, you will likely need to secure financing to build a house. Fortunately, you may be eligible for home construction loans options than can help you turn your vision into a reality. We believe this scoring system best reflects consumers’ top priorities when comparison shopping for mortgage lenders. Prospective custom home builders have to self-finance the design phase of the home building contract.

If after researching how to get a loan to build a house you decide that you’d rather stay in your current home, you might consider tapping into your home equity to renovate, remodel, or upgrade. Another approach is to sell your current home and rent a temporary home while waiting for your new one to be built. While this requires you to move twice, it frees up the equity in your home to use toward your new property. Your next financing steps will depend on whether you have decided to buy a house in production or custom-built home.

When someone decides to build a new dream home, they first start exploring which financing option allows them to build more of a house. Because a construction loan is a little different from conventional mortgages, it’s important to find a construction loan officer who is familiar with new home construction financing. You want someone who is battle-tested and has been through the experience of building a home rather than a loan officer who only has experience financing the purchase of existing homes. Traditionally financed construction loans will require a 20% down payment, but there are government agency programs that lenders can use for lower down payments. Department of Agriculture (USDA) loans are able to qualify borrowers for 0% down. While often more complex than a standard home loan, construction loans can be helpful if you’re building a home from scratch or looking to purchase a home and make major renovations.

“Finding a lender that will process these loans quickly, efficiently, and is staffed with a full team is even rarer,” says Mushlin. Funds from the loan will be kept in an escrow account, and your contractor will be paid in installments as each construction phase is completed. “The land should not require a teardown of the property or have multiple properties on it,” cautions Richie Duncan, senior loan officer with Nationwide Home Loans Group. The standard 203(k) loan even requires a HUD-approved consultant to oversee the project, ensuring proper execution and compliance with FHA guidelines.

Most lenders won’t allow the borrower to act as their own builder because of the complexity of constructing a home and the experience required to comply with building codes. Lenders typically only allow it if the borrower is a licensed builder by trade. Before applying for a construction loan, consider these benefits and drawbacks. Monthly payments on a 5/1 ARM at 6.68 percent would cost about $644 for each $100,000 borrowed over the initial five years, but could climb hundreds of dollars higher afterward, depending on the loan's terms. Our research is designed to provide you with a comprehensive understanding of personal finance services and products that best suit your needs.

And it doesn’t all have to do with consumers—there are several market factors that have forced builders to pump the brakes on new builds. Finding the right loan for your dream home build or renovation project is just a click away. Julie Aragon, CEO and founder of the Julie Aragon Lending Team, says lenders generally view these loans as a greater risk because the home, which ordinarily serves as collateral, does not yet exist. FHA MIP has an upfront cost equal to 1.75% of the loan amount (which can be rolled into the mortgage) as well as an annual charge typically equal to 0.85% of the loan amount and paid monthly.

No comments:

Post a Comment